Get a quick loan

in 5 minutes

Life happens, but we are here to help you get back on track and achieve your goals with a quick and easy, collateral-free personal loan.

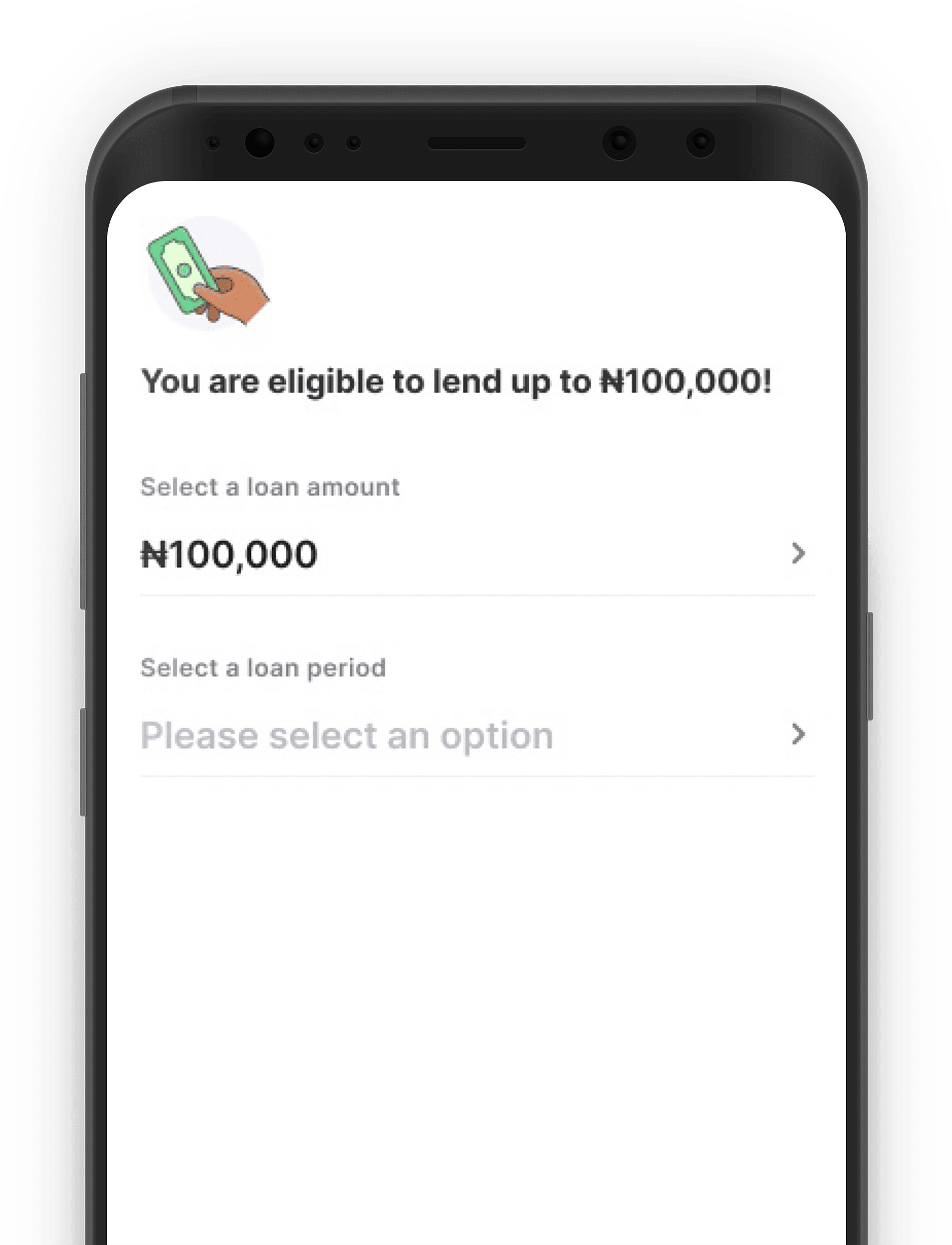

- Interest (total cost of the loan): ₦30,000 (30% rate)

- Three Monthly Payments: ₦43,333

- Total Amount Payable: ₦130,000

- Representative: 120% APR

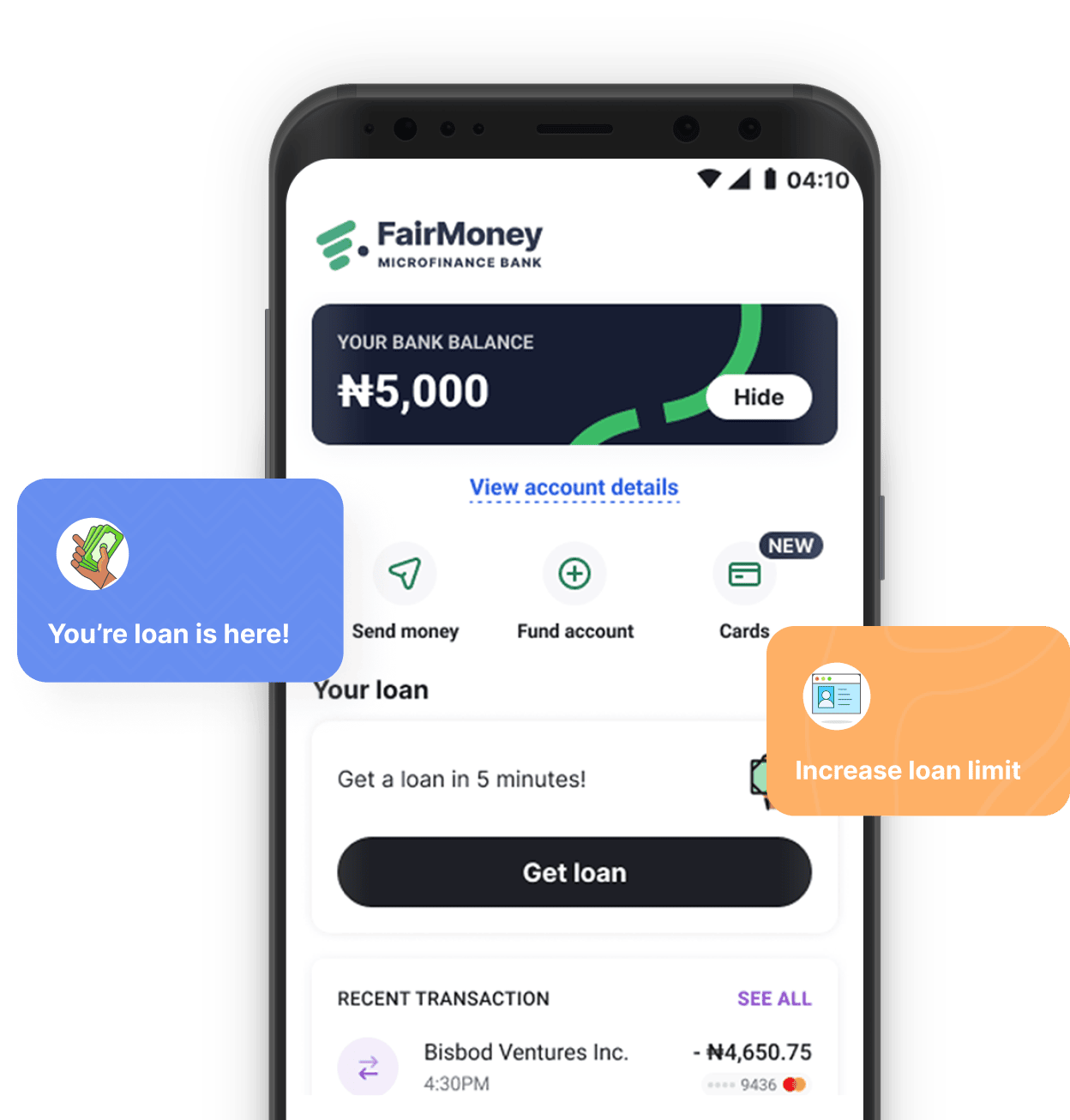

As soon as your previous loan repayment is confirmed, you can reapply immediately and get another loan in seconds!

No document, no collateral! You will only need to share your BVN details during the loan application and connect your card or bank account to authorise us to debit your account for the repayment.

FairMoney offers loans of up to N3,000,000 for a period of up to 24 months. The better your lending history and positive behaviour, the more you can access and the longer your repayment period!

Applying for a loan at FairMoney is easy and simple! Please follow the steps below to access a loan with us:

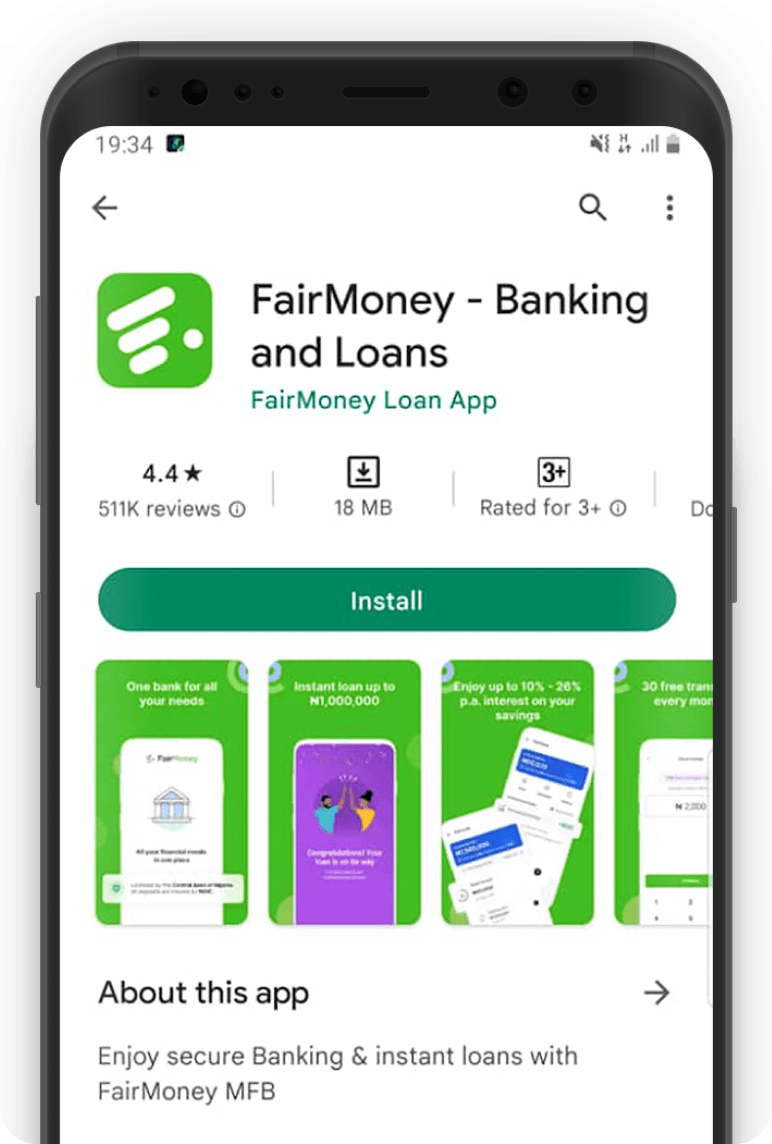

Download the FairMoney App via Google Play Store using this link: https://fairmoney.app.link/9mVwx3ahv9

Sign up with the phone number linked to your BVN.

Answer a few questions, and confirm your identity to receive a loan offer. Once you accept the offer, you will receive your loan within 5 minutes.